How Long Does Life Insurance Take To Pay Out In Texas

For example, a “reasonable timeframe” may mean different lengths of time to different individuals; Claims are not paid according to time past burial, the clock starts for the life insurance company to deny or accept a claim after a claim is submitted.

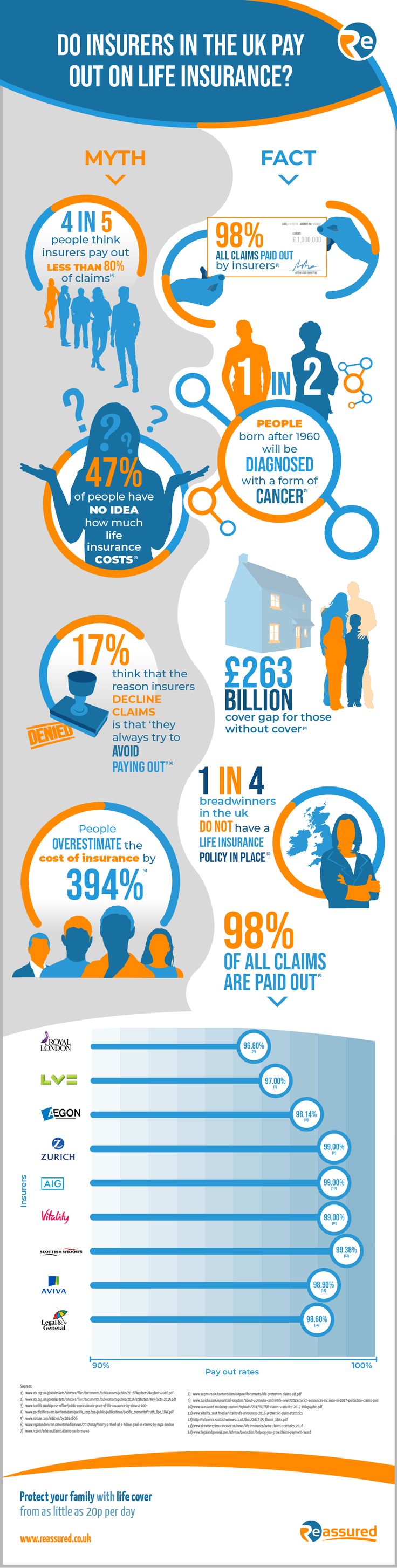

Recent research from a range of sources, including

Lastly, the only policies that are guaranteed, are guaranteed issue life insurance.

How long does life insurance take to pay out in texas. Universal life insurance is more flexible than whole life. Collecting the death benefit is easiest when beneficiaries have details about life insurance policies readily available. In most cases, the insurance company will advise you that the process takes from 5 to 15 days.

If the company's main office is in the same town, your loan could be ready by the next business day. Typically, term life insurance benefits are paid when the insured has died and the beneficiary files a death claim with the insurance company. These policies are typically reserved for people in poor health, and usually only go up to $50,000.

To some, 3 months is reasonable, while to others, 6 months is. At the maturity date, coverage ends and you get the cash value. In many cases, insurers pay death benefits within one month.

Then insurers can payout benefits, deny the claim, or ask for additional information to. Only one death certificate is required regardless of the number of policies or certificates. Just log in to our eservice center to register your policy and make payments.

If you are the owner or beneficiary of a life insurance policy issued in texas, read this post to understand your rights under state and federal law. Texas does not require you to take. Each state regulates the amount of time the life insurance company has to pay a claim, generally, it is between 30 and 60 days.

However, older policies may have a maturity age of 100. So, you may be seeking a product that basically does not exist. If you have all the necessary documents, you may be able to get payment within about seven to 10 days business days, according to estimates on insurance company websites.

If you buy today and die in an accident tomorrow the company may. All three coverage types feature accidental death benefits without a waiting period. A term life insurance policy remains in force as long as the insured is living for the duration of the term, and then it will expire.

A whole life insurance policy remains in force as long as the insured is living and someone is paying the life insurance premiums (unless the policy is paid up). “there is no set time frame, he adds. Most insurance companies pay within 30 to 60 days of the date of the claim, according to chris huntley, founder of huntley wealth & insurance services.

How long does it take for life insurance to pay out? A claim rarely takes more than 60 days after death to be processed by a life insurance company (assuming they have what they need to pay the claim) if all documents are in order, and a claim is straightforward, it can be processed and money can be paid in as little as 10 to 14 days. So it’s something to ask your.

Life insurance payouts can provide crucial funding after a loved one’s death. Globe life and accident insurance company You can change the amount of your premiums and death benefit.

These acts of bad faith, sadly, are not all black and white. Life insurance death benefits are usually paid within 30 days after you submit a claim, according to the american council of life insurers (acli), an industry group. Payouts are not automatic—beneficiaries need to submit a request for benefits.

This can depend on state law and the insurance company's payment. Depending on where you live and state law, an insurance company can take several weeks or several months to issue a payout after you file a home insurance or renters insurance claim. Section 542.057 of the texas statutes states that an insurer must generally pay the accepted claim “no later than the fifth business day after the date notice is made.” in fact, if an insurer fails to do so, you may be entitled to damages.

Loss and claim payment should be mailed within 10 business days after the claim is settled. In general, you can get the money from a life insurance loan anywhere from 1 to 15 days after you request the loan from the company. After you’ve determined which licenses you need, it’s time to begin studying for the texas insurance exams.

Universal life insurance stays in effect until the maturity date, which is usually age 95 or 100, as long as you have $1 or more in cash value. Not surprisingly, the vast majority of complaints stem from issues regarding the handling of claims, which is the reason that people take out insurance in the first place.as of june. Many states allow insurers 30 days to review the claim after receiving a certified copy of the death certificate.

In some places, state law requires insurers to pay in a reasonable amount of time. Failure to reply, whether by accepting or denying, a claim within a reasonable timeframe. The timeline depends on several factors.

While it’s highly unlikely you’ll live to 121, some people with older policies are living to 100 and are encountering this issue with permanent life insurance. These documents should be sent to: The life insurance proceeds will pass into the decedent's probate estate and become available to pay the decedent's final bills.

However, the face amounts are very small and include a graded death benefit feature that lasts 2 years. Bankers conseco life insurance company life claims dept po box 1918 The original insurance contract(s) should also be returned, if available.

Many policies today are set up to mature at age 121, in response to longer life expectancy. Be patient and stay in contact with the insurance company. Within 15 days of receiving all the necessary paperwork, insurance companies must accept or deny the claim.

Life Insurance Cheaper Than TakeOut Life insurance

Tips on whether or not you need longterm care insurance

Understanding Mortgage Terms Understanding mortgages

Hi. My name is Kellogg and yes, I’m a bit cocky, but what

Does your bank machine dispense money or embarrassment

Save Money on Car Expenses Saving money, Saving tips