Return Of Premium Life Insurance Canada

However, “return of premium” (rop) term life insurance removes that negative. Instantly compare term life insurance quotes online for free to get the best term life insurance policy and coverage options.

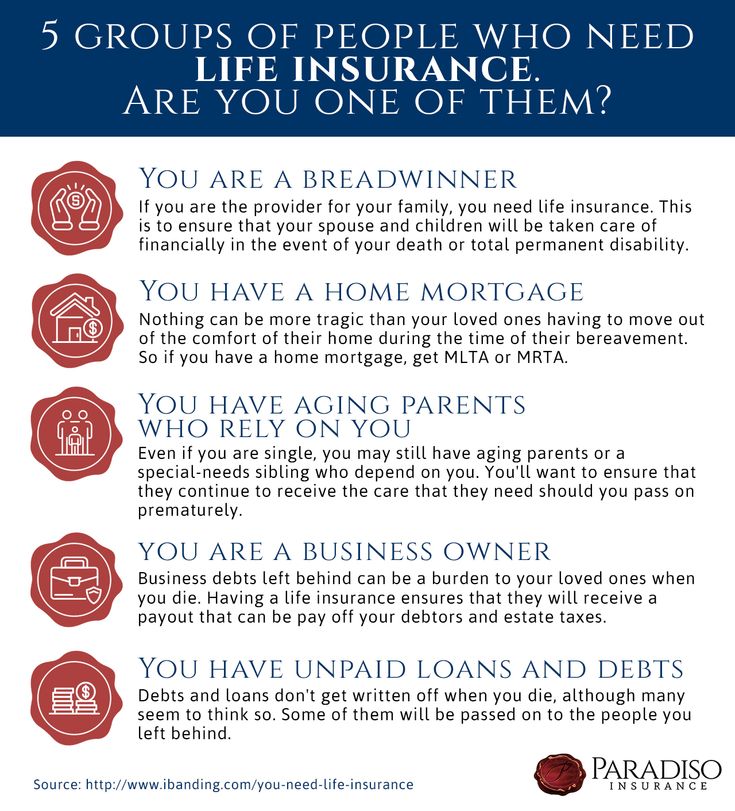

Connecticut Life Insurance Policies Paradiso Insurance

We don’t ask about previous decline history;

Return of premium life insurance canada. But even we buy a term policy that that will last for decades; The return filed by the insurer is due on or before march 15 in each year for each contract of insurance entered into or renewed during the immediately preceding calendar year. If the return is sent by mail, it must be postmarked on or before march 15.

The sum assured in term insurance with return of premium plans refer to the life insurance cover that is offered by the insurer to the insured person at the time of signing up for the plan. A traditional term life insurance policy may give you an option of 15, 20 or 30 years. Continues to pay the premiums.

If your application passed through underwriting, that is a good indication that the life insurance company does not expect you to pass away either. Find the insights and benchmarks you need to make strategic decisions and grow sales. Whole life insurance is a type of irreversible life insurance created to provide life time protection.

Line 10400 was line 104 before tax year 2019. Life insurance in general, in jurisdictions where both terms are utilized, insurance refers to giving coverage for an event that may happen (fire, theft, flooding, and so on), while assurance is the stipulation of protection for an occasion that is particular to happen. You will find actionable information on these and more:

Your spouse, child or anyone else you’ve named as a beneficiary would not have to report life insurance proceeds as taxable income on their canadian tax return. You can continue your coverage beyond the level premium period on an annually renewable basis to age 95. Employer and employee perspectives and actions.

We do not really expect to pass away during that time. Deducts all life insurance policy premiums paid after the donation. Since the return of premium rider ensures against the loss of premiums, it can seem like an attractive option—even if it's really a poor deal.

Return of premium life insurance — or refundable life insurance — combines regular term life insurance with a return of premium feature.you choose the term: Owns a life insurance policy on a key person’s life (such as a shareholder’s). Effective sales, sales processing, and service practices.

Your insurance operates within a set time with one significant difference. The owner can access the cash in the cash worth by withdrawing loan, borrowing the cash money value, or surrendering the policy as well as obtaining the surrender worth. A return of premium policy fulfills the life insurance obligation and returns the premiums if one or both of the partners live past the term.

A pure term life cover is an insurance policy that promises to pay your nominee an amount (sum assured of the policy), if you die. Return of premium insurance builds cash value, which you can borrow against during the level premium period. Term insurance return of premium offers a lower sum assured amount as compared to the pure term insurance policy, as the premium amount refunded

Guaranteed return of premium on death benefit the guaranteed return of premium on death benefit offers an increasing death benefit. How does return of premium term life pay you back? The return of premium life insurance provides a middle ground between term and whole life insurance.

Includes the policy gain, if any, in income. Deducts the fair market value of the policy from income. Donates the policy to a charity.

You pay a fixed annual premium. If you don’t die during its term, you’ll receive all or a portion of the premiums you have paid into the policy. Return of premium on death (ropd) rider is available on all our critical illness plans;

At the end of the term, you get all of the premiums you paid back, as long as you made all. This is available with several carriers, including mutual of omaha, and is the most expensive option you can buy of the three return of premium options. With return of premium (rop) life insurance, you’ll pay a flat rate for the duration of your policy, but you’ll get all your money back at the end of the term.

The best return of premium life. Return of premium life insurance (rop)—sometimes called return of premium. But it doesn’t come bundled with investment, unlike traditional.

20, 25, or 30 years. Return of premium, often referred to as “full return of premium,” will give your beneficiary a death benefit equal to the sum of your ltc premiums paid over time. A group term life insurance policy is a policy where the only amounts payable by the insurer are policy dividends, experience rating refunds, and amounts payable on the death or disability of an employee or former employee.

The return must be sent to the address indicated in paragraph 12. An rop plan pays back your premiums in part or in full if you outlive your policy. Return of premium insurance refunds your life insurance payments if you outlive the policy’s term, but comes with some caveats.

How return of premium policies work. To keep traditional life insurance policies active, you make monthly or annual payments that are not refundable. Premiums will increase annually but will.

Return of premium life insurance.

Nature her beauty and the wonders found within her embrace

Infographic Millennialls & Life Insurance

Are you thinking about buying Term life insurance? See

If you buy a life insurance then you protect your loved

Bestow Review Get Affordable Term Life Insurance Online

Your Guide To Term Life Insurance in 2020 Term life

Most recent Snap Shots lifeinsurancepolicy

Tax Trivia The word “tax” originates from the Latin verb

Useful Suggestions For The Insurance Issues Commercial

Pin by Life Insurance Expertise on Learn About Life

Ethos Life Insurance Review Get Coverage in Under 10

What Are All The Documents Required For EFiling tax

How can Canada's term life insurance products stack up

HP Premier Plus Inkjet Print Photo Paper Letter 8 1/2

Best Cash Back Credit Cards in Canada 2019 Best travel